Affordable Lending Campaign launches as research reveals people are jumping into quick credit without realising the true cost

London, 10 September 2014 | Economy

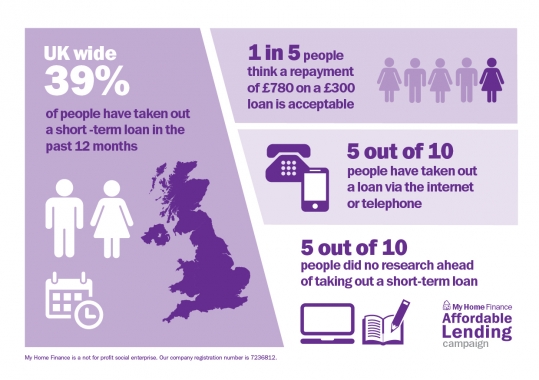

Latest research findings revealed today from My Home Finance, a national social lending organisation, show it has become morally acceptable for individuals to pay extortionate rates for short-term loans, with no questions asked by the loan provider to determine whether they can afford it.

On the launch of My Home Finance’s Affordable Lending Campaign, findings show that nearly 1 in 4 people are using the Internet and telephone to access short-term loans, with nearly 50% of applicants not doing any research ahead of hitting the "accept" button. Worryingly, over a quarter of people had no idea of the actual cost of the loan they took out – most people just picked a company they had heard of when they needed money.

Tess Pendle, Chief Executive of My Home Finance said:

“Latest findings show an alarming culture has developed, where people think its perfectly acceptable not to check what the actual cost of the loan is; and worse – companies are lending to people without assessing if they can actually afford to repay the loan.

Nearly one in five people who took out a loan think it is absolutely normal to pay at least £780 back on a £300 loan. It isn’t, and it needs to stop”.

My Home Finance is today (Sep.10) launching an awareness campaign, with a host of 21 supporting partner organisations throughout the UK including housing associations, credit unions, a local authority, community organisations, the CDFA (Community Development Finance Association), Toynbee Hall and the National Housing Federation- all of which believe that the need for affordable lending for all, and access to financial educational must be made a priority.

Read MoreBen Hughes, Chief Executive of the Community Development Finance Association believes:

"We should all have the basic right of access to fair finance. Like all our members, My Home Finance is changing lives and putting wealth back into communities. But more people need to know about the affordable loans that are on offer and that won't trap them in spirals of debt. More investment is needed to link up community lending, savings and advice services."

John Cockerham, Director of Neighbourhood Services at the Guinness Partnership thinks:

“Improving access to more affordable lending can have a positive impact on a person’s life and My Home Finance is accessible to everyone, regardless of previous credit history. Working in partnership we are trying to make sure that our customers can benefit from affordable lending”.

Tess Pendle concluded:

“We need a huge change in the way customers of short term lending are given choices and information on what the actual cost of the loan is. Customers have been led to believe that it is fine for them to be allowed to take out credit, without any affordability checks; but this usually means that they have to pay it back at gigantic interest rates. What kind of society are we when we do not allow people to borrow in a way that enables them to still be in control of their money?"

Leave comments