European Commission publishes AGS kicking off the 2016 Semester cycle

What’s in it for housing providers? A Housing Europe analysis

Brussels, 4 December 2015 | Published in Economy

The 2016 Annual Growth Survey (AGS) was published on 26 November, kicking off the European Semester cycle for 2016. A Housing Europe analysis.

To strengthen the recovery and foster convergence, the Commission recommends building on the three main pillars identified last year for the EU's economic and social policy: re-launching investment, pursuing structural reforms and responsible fiscal policies.

Positive points are the focus on the potential of the European fund for strategic investment, and on identifying challenges to investment and their possible removal. Furthermore, there’s a positive message about social investment, including in housing: ‘It is essential that Member States promote social investment more broadly, including in healthcare, childcare, housing support and rehabilitation services to strengthen people's current and future capacities to engage in the labour market and adapt’.

At the same time as the AGS, two important documents were published: the Alert Mechanism Report (AMR) and the Joint Employment Report (JER). These two report accompanying the AGS show a somewhat divergent view on housing: if the AMR represents the macroeconomic outlook, the JER concentrates on social aspects and related policies.

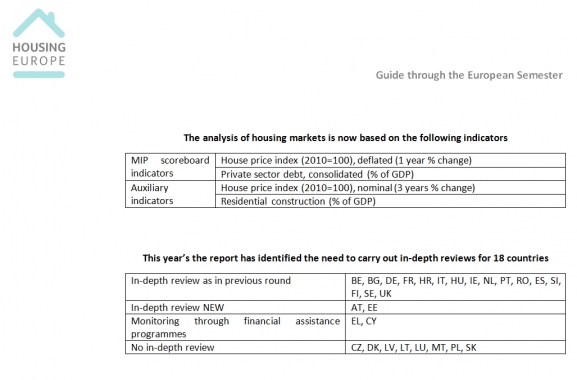

The AMR looks at a number of macroeconomics indicators, and carries out a first analysis to determine which countries will have to undergo in-depth reviews. Among other aspects, it looks at housing market trends as one of the areas determining potential instability.

As of this year, there is also a general stronger focus on employment and social performance in the AMR: besides the percentage of people at risk of poverty and those in severe material deprivation, auxiliary indicators now include activity rate, youth unemployment, long-term unemployment. Nevertheless, no indicator on housing affordability and/or housing exclusion have been included so far in this process.

This is despite the fact that the Joint Employment Report (JER) has clearly identified housing overburden rate as one of the key social trends to watch. According to the 2016 JRE, in 2012-13, the indicator has significantly deteriorated in CZ, EL, HR, IT, LU, NL, SI, FI, UK. On the contrary, it has improved in BE, EE, FR, HU, RO.

Read MoreTaking into account the different perspectives, what trends in housing emerge from these two reports, the AMR and JRE?

The AMR highlights that ‘In 2014, the evolution of house prices reflected different positions in housing cycles across the EU. The annual change in inflation-adjusted house prices in 2014 varied from more than a 5 per cent fall in Slovenia and Greece to surges well above the indicative threshold of 6 per cent in Ireland and Estonia. This widening of the distribution reflects different positions in the housing cycle and different risks. In some Member States, prices underwent a sharp correction during the crisis and reached levels that are well below what would be implied by fundamentals. This is the case of Irish house prices that sharply increased during the last year. Similarly, Hungary, Estonia, Lithuania and Slovakia also exhibited important real house price increases. House prices in these countries are assessed as still undervalued, so the recovery pace may not signal a new build-up of risks in the near future. Conversely, in Member States where house price are still assessed to be overvalued, such as Sweden or the United Kingdom, house prices increased from very high valuation levels and require careful monitoring.

It is therefore very likely that the in-depth analysis for UK and SE will have a strong focus on their respective housing markets. Overall, this year the report has identified the need to carry out in-depht reviews for 18 countries.

The JRE finds that ‘considerable commitments were taken to improve access to affordable housing. Some Member States adopted plans for construction of housing or social housing (CZ, FR, IE, PT, SI, UK). Bulgaria used the European Regional Development Fund to improve access to housing for people in vulnerable situations. Extending schemes to help first-home buyers were reported in Hungary and a mobility scheme for social housing tenants in the United Kingdom. The conditions of housing allowance, including eligibility criteria and thresholds were revised (CZ, FI) and rent controls/guarantees were put into place for social purposes (BE, CZ, FR, NL). Many programmes aimed at tackling over-indebtedness and evictions, such as the debt detection business cases in the Netherlands and the pilot projects helping evicted families in Slovenia. The eligibility threshold for insolvency protection was lowered in Latvia, while Cyprus offered subsidised mortgage interest payments for vulnerable households. Targeted efforts were also made to confront energy poverty (Belgium) and integrate social housing service provisions (Ireland).’