New study and upcoming conference: The price-dampening effect of limited-profit housing in Austria

Gerald Koessl, Austrian Federation of Limited-Profit Housing Associations (GBV), a member of Housing Europe

Vienna, Austria, 20 July 2023 | Economy

Affordable housing provided by limited-profit housing associations (LPHA) has positive impacts not only on their tenants and the economy (as a previous study showed) but also influences prices on the housing market more widely. Our member, Gerald Koessl explains more.

The expansion of limited-profit housing in Austria

Limited-Profit Housing Associations (LPHA) in Austria provide cost-based housing to broad sections of the population. Cost-based rents mean that LPHA neither charges more nor less than is necessary to recover the cost of construction, financing, and maintenance for a particular building. Cost calculation hence takes place at a building-block level. A new study conducted by the Austrian Institute of Economic Research and the Federation of LPHA evidences the price-dampening effect of this type of cost-based housing on the wider housing market.

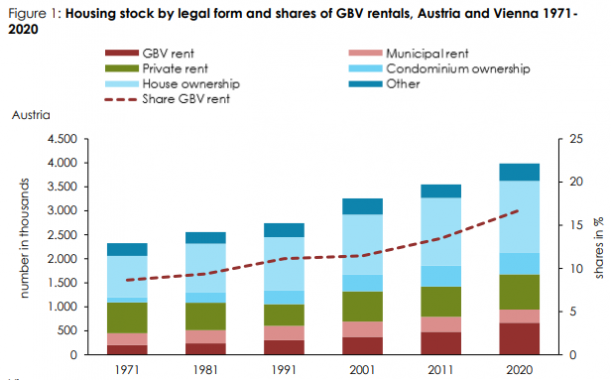

Around 1 in 6 (17%) Austrian households live in rented homes provided by LPHA and the share reaches around a quarter (1 in 4) in urban areas. The share of limited-profit housing has expanded gradually over the last decades, from about 9% of the Austrian housing market in 1971 to 17% in 2020.

Figure 1: Housing stock by legal tenure and shares of LPHA (GBV) rent in the total housing market, 1971-2020 (see in the download section)

Cost-based housing has a price-dampening effect

Affordable housing provided by LPHA has positive impacts not only on LPHA tenants and the economy (as a previous study showed) but also influences prices in the housing market more widely. A new study demonstrates this price-dampening effect. On average rents in limited-profit housing are around a quarter below rents in the private rented sector (PRS) and the price difference is even higher in urban areas. The study proves that in addition to being more affordable, limited-profit housing also exerts a price-dampening effect on the unregulated private rented market in the region of 5%. Importantly, this effect varies not only from region to region but also across time, depending on the market share of limited-profit housing.

Despite these variations, the study concludes that an increase in the market share of cost-based rental housing by 10% reduces rents in the PRS by around 30-40 Cents per square metre or between 250 to 340 Euros for an average home every year. Figure 2 illustrates this effect. It shows that in localities with a small share of LPHA rented housing, the price difference to the PRS is well above 2 Euros per square metre. In other words, in areas where limited-profit housing has little presence on the (rented) housing market, private landlords face less competition from (cost-based) rents of LPHA and are hence able to add a higher profit-margin.

The higher the share of limited-profit housing (moving along the x-axis in Figure 2), the lower the price difference between limited-profit and for-profit housing becomes. In such markets, cost-based prices of LPHA send a “price-signal” to the housing market as to the real cost of housing and the prices set by for-profit-providers converge to cost-based rents.

Figure 2: Rent differentials between LPHA (GBV) and private, unregulated housing – non-linear (see graph in the download section)

High quality as a key feature of limited-profit housing

The market interaction between limited-profit and for-profit housing is however not only happening at a price level but also at a quality level. Historic analyses show that limited-profit housing set new standards in the 1970s and 1980s, a time when a high share of the private rented sector was considered to be sub-standard. While this “quality gap” has narrowed over the decades, it is still measurable in official statistics. Even today, the energy efficiency and the specification of homes provided by LPHA is better than in the private rented sector.

Policy implications

The lessons for policymakers are manyfold. Affordable and secure housing is not only beneficial to residents who live in limited-profit housing but has a positive impact on renters in the wider housing market. Importantly, the effect of cost-based housing is significantly stronger than merely an increase in the supply (of market-based) housing. The structure of new supply hence matters. More lessons will be discussed with an international audience at the upcoming conference “Shaping housing markets – the economic impacts of affordable housing” on 19 September 2023 in Vienna. For more information and registration, please visit: https://www.gbv.at/AktuelleMeldungen/2023/Shaping%20housing%20markets/

Link to full study and interactive visualisations:

The price dampening effect of non-profit housing (2023)

https://non-profit-housing.wifo.ac.at/

Leave comments