A new study by Michael Klien and Gerhard Streicher, from the Austrian Institute of Economic Research (WIFO), quantifies the impacts of limited-profit housing on purchasing power, GDP, and the public purse. The study illustrates that limited-profit housing associations not only provide affordable and secure homes but are a financial net-benefit to individual households, the economy, and the public purse, Gerald Kossl from Housing Europe’s Austrian member, GBV writes for our blog.

The role of limited-profit housing in Austria

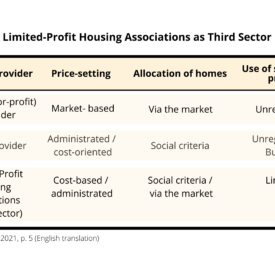

Limited-Profit Housing Associations (LPHA) play an important role in Austria’s housing market. The approx. 650,000 rented homes provided by LPHA represent 40% of all rented homes and 17% of the total housing stock in Austria. In addition to rented homes, LPHA also provide homes for ownership. Since 1945 LPHA have completed about 360.000 homes for individual ownership, which represents about half of all flats in owner-occupation(1) in Austria. While homes for ownership and for rent have played an almost equally important role historically, previous decades have seen a clear shift towards homes built for rent, albeit with the option to buy under certain conditions(2). The WIFO report also highlights the distinctive role of LPHA as agents of the Third Sector, that is, as housing providers that are neither profit-driven nor state-dependent. Specifically, this role is evident in three broad areas: price-setting, allocation of homes and the use of surpluses.

The growing gap between cost-based and market-based rents

The report lists various factors that explain the price difference between for-profit and limited-profit housing providers. While there are some legal and financial factors enabling LPHA to offer homes at a lower price than for-profit providers (e.g. preferential access to low-interest public loans and public land, exemption from corporation tax) the report clearly states that today the main reason for lower prices in the LPHA are linked to the LPHA business model and in particular to the cost-based pricing of rents instead of (higher) market rents. In other words, the main reason why rents in newly built LPHA homes are cheaper than rents in the private sector is the absence of the profit-surcharge. Any surpluses of LPHA are instead continuously reinvested in the sector (revolving fund). Given the rapidly rising costs of market-based prices in recent years, the gap between for-profit and limited-profit rents has grown. While in 2006 average limited-profit rents (per square metre) were 14% below for-profit rents, the gap has widened to 22% in 2019.

The price difference is particularly pronounced in urban areas and in new builds. While the average price difference across the entire housing stock is 2.3 Euros per square metre per month, the figure is about 3 Euros in urban areas and in homes built since 2011. There is however also a significant price difference in towns and suburbs (2,0 Euros) and rural areas (1.2 Euros). For a 70 square metre flat the average saving amounts to 160 Euros per month, rising to about 200 Euros in urban areas.

Total savings to households amount to 1.3bn Euros per year

The report calculates an estimate of the total savings by all households renting from a LPHA compared to the scenario that these households were paying private sector rents. If all 650,000 households currently renting from a LPHA had to pay private sector rents for the type and size of home they live in, the total additional rent would amount to 1.2bn Euros per year. Put differently, affordable rents provided by LPHA save (LPHA) tenants more than a billion Euros per year. The estimated savings for reduced purchase prices for owner-occupiers amounts to around 120m Euros per year in total, or around 60 Euros per household per month. Taken together, the total savings (from rent and ownership) amount to 1.3bn Euros per year, which has significant impacts on purchasing power.

Impacts on the economy: higher GDP and purchasing power and reduced state expenditure

The study also estimates the economic impacts of LPHA activity on the wider economy in terms of GDP and purchasing power. Depending on the assumptions taken in the economic models, LPHA are estimated to add an additional 600 million to 1 billion Euros to Austria’s GDP every year. The report develops two different scenarios which compare the (hypothetical) situations without and with LPHA in the Austrian housing market. In other words, the results give an indication of the additional effects of LPHA, compared to a scenario that LPHA homes were provided by for-profit actors. The first scenario only considers the economic effects of LPHA related to lower housing costs but without any additional demand for and investment into housing construction (e.g. as a result of growing demand for larger homes). The second scenario also considers the additionality of LPHA activity on housing output (i.e. LPHA and for-profit providers do not replace 1:1 but both actors complement each other, households show a growing demand for larger/better equipped homes). The report quantifies the impact of LPHA on Austria’s GDP as follows:

- Increased private consumption: better affordability due to lower housing costs result in additional private consumption between 290m (Sc. 2) and 420m (Sc. 1) Euros per year. The higher amount is the result in the first scenario, where all the effects derive from reduced housing costs.

- Increased public investment: the public purse saves money (e.g. due to lower expenditure on housing allowances, higher tax income from other consumer goods) and is able to spend more on other areas, which in turn leads to higher GDP. The report estimates this effect to be in region of 400m (Sc. 2) to 500m (Sc. 1) Euros per year.

- Increased total investment: higher consumer spending and additional investments into housing are estimated to add between 260m (Sc. 1) and 730m (Sc. 2) Euros to Austria’s GDP (depending on the scenario). Total investment is higher in the second scenario, where an additional demand for housing is assumed.

- Reduced net exports: Housing is a good that is predominantly produced within Austria. Lower housing costs and as result higher expenditure on consumer goods – often produced outside Austria – mean higher imports (or lower net exports). The model assumes the reduction to be in the region of 440m to 530m Euros.

Crucially, the report shows that LPHA are a net-benefit to households, the economy, and the public purse. Contrary to commonly held assumptions about the limited-profit housing sector being a “subsidised sector”, the report provides evidence that the activities of limited-profit housing associations in Austria are not only important in terms of providing affordable and secure housing but also add significantly to economic prosperity and economic stability. In brief: LPHA residents benefit from reduced housing costs, which in turn increases their purchasing power (after housing costs), which adds to GDP and reduces the need for housing allowances. The benefits to individual household budgets and to the public purse by far outweigh the public money invested in the first place. These efficiencies are mainly the result of the economic model of limited-profit housing, which, instead of paying out profits to shareholders, reinvests any surpluses back into new construction or renovation (revolving fund model). The report also makes clear that these benefits are particularly evident now, at a time of increased pressures in the housing market. As such, the report describes the nature of limited-profit rent setting, which guarantees affordable and secure rents in perpetuity, as an “insurance” against the unpredictable and volatile nature of housing markets.

References:

Michael Klien und Gerhard Streicher (2021): Ökonomische Wirkungen des gemeinnützigen Wohnbaus. Österreichisches Institut für Wirtschaftsforschung – WIFO.

(1) Flat ownership in multi-storey apartment blocks is a distinct tenure (Wohnungseigentum) in Austria, with its own legal basis (Wohnungseigentumsgesetz).

(2) The right-to-acquire was introduced in 1993. Tenants who pay an equity contribution in excess of 72 Euros per square metre at the beginning of their tenancy acquire the right to buy their home after five years (until 2019 the law required a continuous tenancy of at least ten years).

Full report (in German) is available HERE

An English summary is available HERE

-275x275.png)