The latest round of EU ‘Survey of Income and Living Conditions’ (EU-SILC) data have recently been published by Eurostat, covering the 2018 period. The SILC figures indicate that the recent trend in ‘at risk of poverty or social exclusion’ rates has continued to edge down at an EU level; from 22.4 per cent in 2017 to 21.7 per cent. While the exact percentages vary wildly from country to country (e.g. 32.8 per cent in Bulgaria compared to just 12.2 per cent in Czechia), there is also a huge amount of variation at an EU level between different housing tenures. The 2018 figures show that just 9.3 per cent of mortgage holders in the EU are at risk of poverty. This compares to 20.1 per cent of outright owners, 32.9 per cent of those paying private market rents and a staggering 38.4 per cent of those renting at below market rates.

By Dara Turnbull

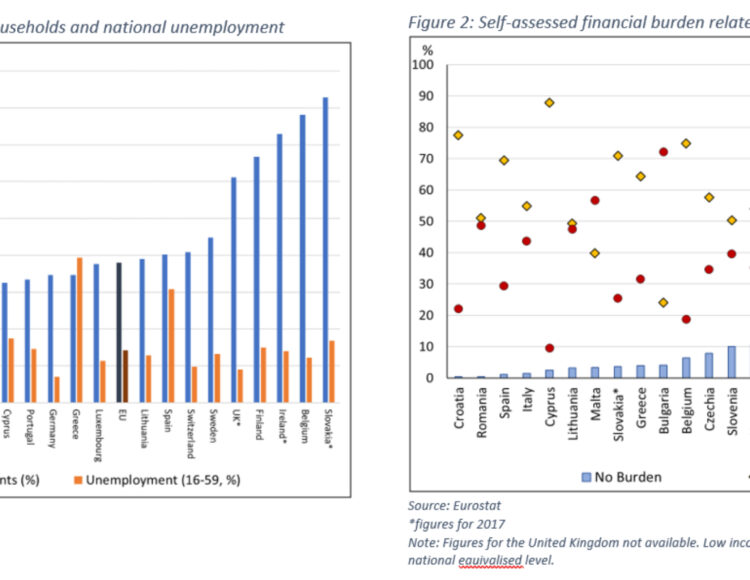

Meantime, the SILC data also show that the rate of those living in households with ‘very low work intensity’[1] has continued to edge down in the EU as a whole, from 9.5 per cent in 2017 to 9 per cent. However, the rate amongst those living in households paying below market rents was 19 per cent in 2018. While this represents a slight decline compared to 2017, it is higher than the 17.2 per cent rate recorded a decade ago in 2008, despite almost identical unemployment rates in the two years.

Most worrying of all is the vast disparities which exist between countries in the EU and the relationship of the national figures to unemployment rates in those countries. As shown in the above chart, rates of low labour market activity amongst social tenants significantly outstrip unemployment rates in a number of countries. This dichotomy is particularly pronounced in Slovakia, Belgium, Ireland, Finland and the United Kingdom. What this suggests is that the social housing sector[2] in these countries is highly ‘residualised’.

Residualisation is the process by which social housing stocks become insufficient to meet a general demand from lower and medium income households and thus those who can find other forms of accommodation do so, leaving a ‘residue’ made up of only the most economically marginalised households.

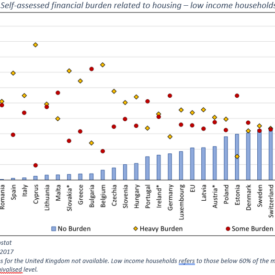

However, the degree to which social housing becomes residualised only reflects one form of policy failure with relation to supporting those on lower incomes. Another form is allowing underlying economic and population dynamics to dictate that meeting basic housing needs poses a meaningful financial burden. The above chart shows that this is the case in a number of EU countries. In the Netherlands, a country in which 30 per cent of the housing stock consists of social housing, almost 45 per cent of low-income households say they face no financial burden related to housing. At the other end of the spectrum, in Croatia only 0.4 per cent of low-income households faced no financial burden. Just under 2 per cent of the housing stock in Croatia is public.

As well as low levels of social and affordable housing, our recent report ‘The State of Housing in the EU 2019’ showed that countries that struggle to provide affordable housing also tend to have low levels of spending on housing related welfare payments, below average labour force participation and weak levels of activity in the construction sector.

Overall, then, the SILC figures for 2018 continue to show that it is imperative that governments in many EU countries act now to tackle social isolation and the factors which can lead to housing affordability issues. This will require meaningful reflection, political determination and public investment.

[1] It should be noted that quirks in the EU-SILC classifications of housing tenure can sometimes mean that some ostensibly social tenants are classified under the private tenant category. This is particularly the case in the Netherlands, Denmark and Sweden.